How to use future transactions to maximize the profit of cryptocurrencies

The world of cryptocurrencies trading exponentially has increased: millions of investors are pursuing the market in search of a great return. Although traditional trade methods have their limitations, futures tradition offers a unique opportunity to maximize profits in this area. In this article, we will embark on the foundations of future transactions and provide strategies to use cryptocurrency as a profit.

What are future contracts?

The future agreement is an agreement between two sides to buy or sell real estate at a predetermined price at a certain time in the future. The contract is resolved when the buyer submits a property and the seller accepts it. Future transactions allow traders to provide themselves from potential losses or profits due to the changes in the market, making them a popular selection for specculants.

Use of Crypto Currency as a merchant vehicle

In recent years, crypto currencies such as Bitcoin (BTC), Ethereum (ETH) and Litecoin (LTC) have been becoming more unstable in recent years. When the market has grown, make your prices creating the potential for traders to profit from the fluctuation of prices. Here are some ways to use future cryptocurrency transactions:

1.

Buy future transactions Buy

By investing in future transactions, you can buy or sell crypto currencies at a predetermined price in a particular future. This can help you secure yourself from potential losses or profits, as well as for the use of prices changes.

* Market Risk : Valapity Cryptocurrency Price causes a market risk when trading in future transactions. Moving high prices can cause significant losses.

* Liquidity : The cryptocurrency markets are relatively illantic compared to traditional markets. This can make it difficult to quickly enter or exit, resulting in increasing the risk of loss.

2.

Selling future transactions

Since trade contracts allow you to sell cryptocurrencies at a predetermined price at some point in the future. This can help you make a profit from pricing changes.

* Liquidity : Since the cryptocurrency markets are quite liquid, it is easier to quickly introduce or go into the store.

* risk management : Sales of future transactions is associated with protection against potential losses. You can take this opportunity to close positions and record profits when the market is moving to your advantage.

3.

Osions trade

The shop for future contracts allows you to help you get a profit, buy or sell crypto currency at a predetermined price in a particular future.

* Protection : Position trading helps to ensure potential losses when locking profits.

* risk management : Using stopping order and other risk management methods, you can reduce the effect of fluctuations on the market.

4.

Using technical analysis

Technical analysis includes studies of charts and models to predict future prices changes. This approach can help determine the trends, support and resistance levels that allow traders to help in profit.

* Trend follows : The trend continuation involves determining profitable transactions based on technical indicators.

* Average Refund : Average reversibility includes a scheduled price refund, taking into account previous results and moods on the market.

5.

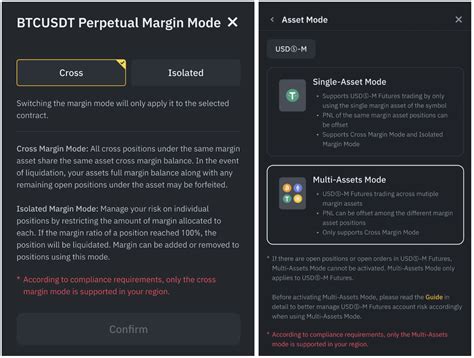

use of lever

Increases allow traders to strengthen their positions, increase potential profits and increase the risk of loss.

* risk management : Using influence requires careful risk management because even low losses can lead to great benefits.

* Liquidity : Pole trading increases liquidity, facilitating the quickly introduction or abandonment of the store.

Conclusion

The future store offers a unique opportunity to maximize profit in the cryptocurrency market.