Rewards in the cryptic trading: Success Strategies

The world of crypto -trading has been becoming increasingly popular over the past decade, with millions of people around the world investing their hard -earned money in digital assets. Although potential rewards may be significant, it is necessary to understand the strategies associated with the success of this rapidly developing market.

What are the rewards for a crypt trading?

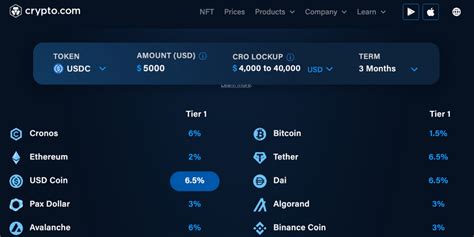

When trading in crypt, remuneration applies to benefits or revenues that come from the successful implementation of stores. These rewards may include:

- Trading profits : The amount of money earned by the merchant at each store.

- Commercial fees : Reduced trading costs, such as lower commission rates or interest on borrowed funds.

- Liquidity insurance : higher prices for purchases or selling assets due to market demand.

Success strategies in the cryptic trading

Consider the following strategies to maximize your rewards and achieve success in crypt trading:

1.

Diversification is key

Diversification of the portfolio in various cryptomains, asset classes and markets can help you minimize the risk and increase potential rewards. By distributing your investments in different assets, you will have better equipment to drive the market fluctuations and use trend -based shops.

2.

Know your markets

Understanding the basic economics of every cryptomena is decisive for successful trading. Research trends on the market, analyze the technical indicators and stay in the current state of regulatory development to make informed decisions.

3.

Technical analysis

Technical analysis (TA) includes the use of graphs, patterns and other tools to predict future cryptomained prices. By identifying trend lines, levels of support and resistance and potential reversals, you can increase your chances of successful business.

4.

Risk Management

Risk control is essential to maximize remuneration in crypt trading. Set up the stop orders, use the size of the positions and limit your exposure to high -risk stores to minimize losses and maximize profits.

5.

Use your store

Using the lever effect allows you to increase your potential returns at each store, but also amplifies potential losses if the shop is not in your favor. Strategically use a lever effect, taking into account factors such as risk tolerance and market conditions.

6.

Stay informed

Staying informed about the market news, regulatory development and technological progress is essential for success in the crypt trading. Follow serious sources, visit webinars and participate in online communities to stay in front of the curve.

7.

Constantly learn and enhance

The cryptomen space is constantly evolving and new technologies and trends are regularly emerging. Continue from your experience, customize your strategies as needed and improve your approach to improve your results.

Example strategies:

1.

- Daily lever trafficking : Use lever effect for a short -term store, with small profits from each store while limiting potential losses.

- Swing Trading : Identify trends and dynamics using shorter time frames (eg 1-5 days) to use movement movements.

Conclusion

Remunerations in the crypt trading are achieved by the right strategies, risk management techniques and deep understanding of the market dynamics. By diversifying the portfolio, to remain informed and constantly learning and improving, you will be well equipped to orientate in the complex world of cryptom trading and maximize your rewards.

Remember that successful cryptom trading requires patience, discipline and willingness to adapt to changing market conditions.